#3 DBS Cashline: Continuous Discovery

How might we increase user retention and product usage amongst Cashline users?

2022 Q3 Pilot Cohort (Oct - Dec)

2023 Q4 Cohort (Oct - Dec)

Role: Team Member (2022), Returning “Practioner” (2023)

About Continuous Discovery (CD)

Research Objective & Methods

-

To understand customers' behaviour and motivations for calling in for help and improve their experience with DBS Cashline. In turn, reducing the high volume of customer calls.

-

Interviews were central to allowing customers to explain the patterns we were seeing in quantitative business data.

Scope was kept small and short, in order to fit research and proposed solutions into ongoing workflows.

As most participants had no training in qualitative research, they needed to shift their mindset towards "customer needs" instead of "business wants".

-

We captured verbatims, pain points, needs and customer job-to-be-done, synthesising what customers said.

-

By organising the key customer needs and pain points, we looked for opportunities to improve customer experience.

-

After the CD project concluded, we tried to implement the chosen solution where we had control in our respective departments, or passing on our findings to the most relevant department.

Key Findings

Opportunity Solution Tree

Outcome Focus: Improve user retention & product usage

Mapped below are opportunities to meet unmet customer needs, pain points or desires, with more details of the context and what customers said verbatim.

At the end, the team ranked the most valuable opportunity to focus on against impact and effort.

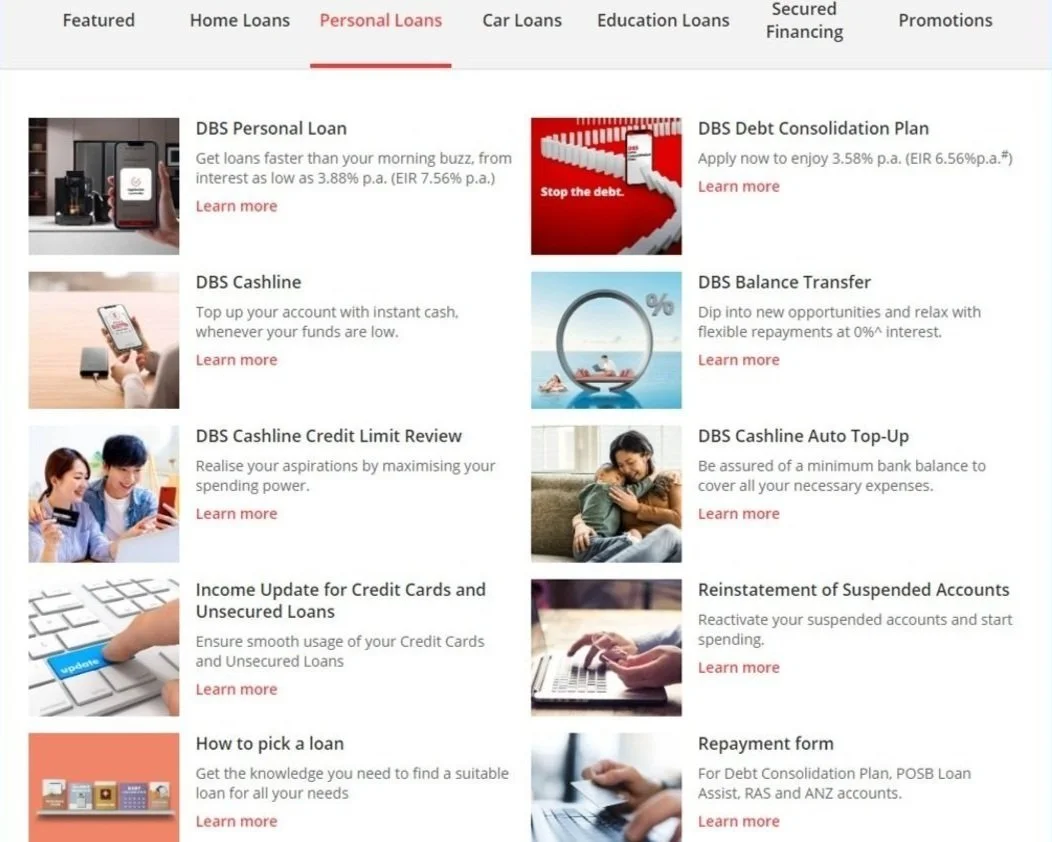

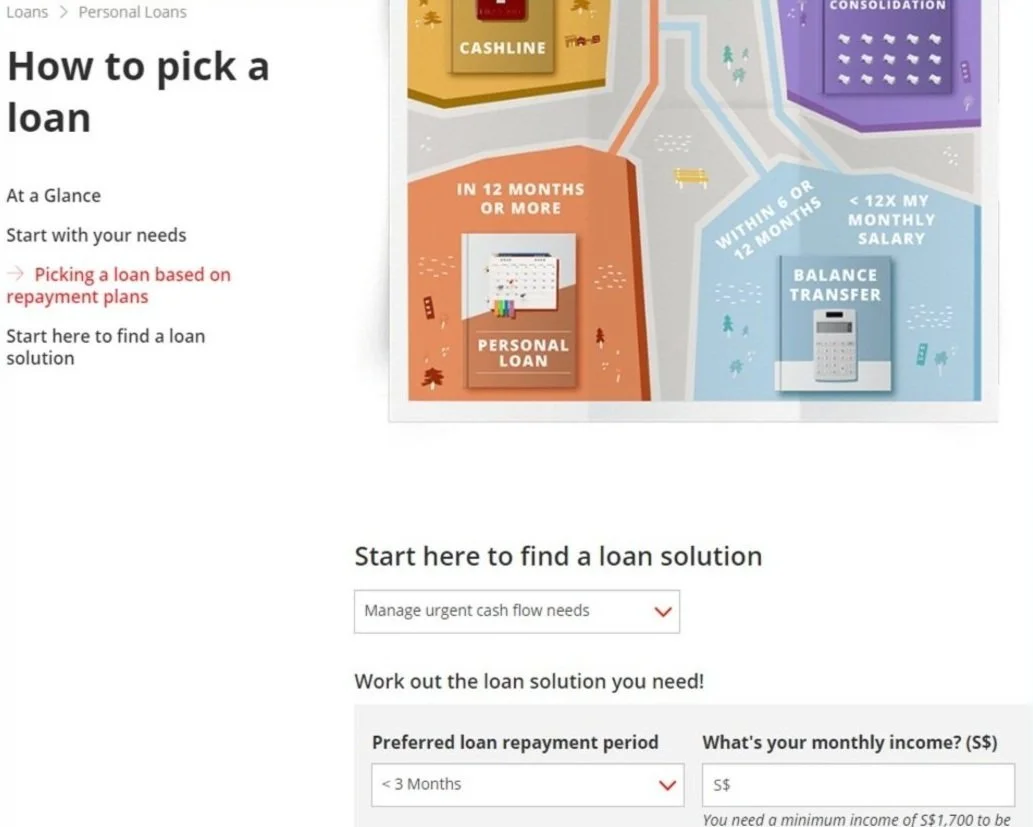

1 - I need the right loan for my needs

-

Fees, interest charges and calculations, payment schedules and other terms & conditions can feel overwhelming for the customer.

For the business, it would be valuable to guide customers who have immediate needs for financing as efficiently as possible as they are warm, valuable leads.

-

Understandably, customers seek the lowest interest rates: even a small difference impacts total borrowing cost significantly.

As with differentiating between loan products , the many factors - risk assessment, customer credit worthiness, loan purpose, loan term and repayment schedule - that weigh into the final interest rate offered can be confusing.

While the bank should be cautious of potential exploiters, providing information in a transparent way for the average customer would build trust and help the customer make an informed decision.

-

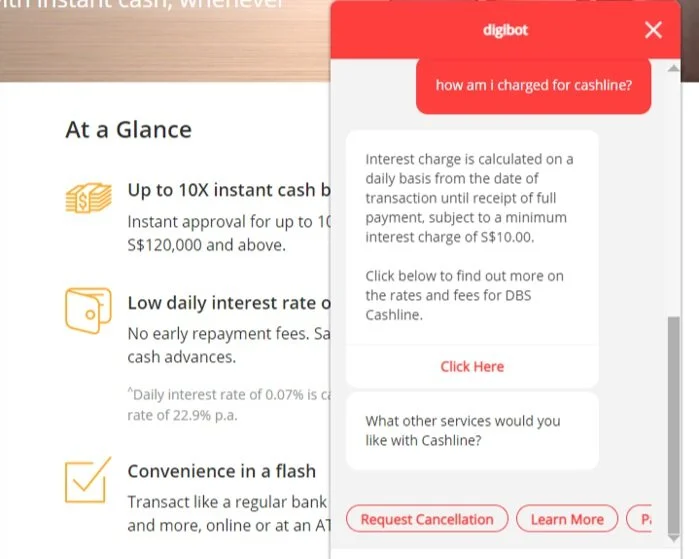

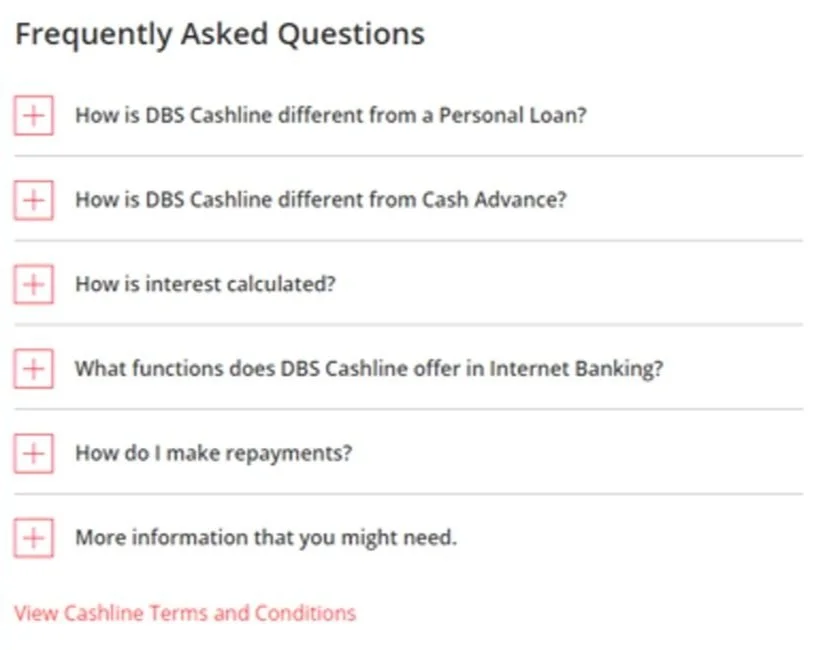

Customer feedback indicated that existing online information (FAQs, chatbot) was not comprehensive enough for them to understand their interest rates and payment terms. They felt self-service channels like chatbots and FAQs, was unhelpful for complex questions, hence preferring to contact a helpdesk representative to receive clear and direct answers from a real person.

From a cost and efficiency standpoint, self-service channels are important for businesses and helpful to customers, but we could review the information we provide and how we present it to make it easier for customers.

2 - I am encouraged to use Cashline if there are good offers

-

As the market it competitive, some customers expect fees to be waived as a standard service. Also, fees are an additional expense on top of interest charges and especially for inactive customers, they may feel the fee outweighs any benefit they received from Cashline.

However, the bank needs to account for cost of reserving the credit for the customer and other administrative costs such as account monitoring and fraud prevention. Lines of credit like Cashline can be riskier for banks since borrowers can withdraw funds repeatedly.

-

Customers enjoy discounts as they may feel they are getting a better deal, as well as directly saving money. In today's world, promotions can introduce customers to useful products and services that they might not have otherwise considered.

3- I am worried about being in debt

-

With the shift to digital communication in today's age, customers may miss payment reminders due to information overload, or conscious filtering of emails and push alerts.

Furthermore, they may struggle with banking jargon used like "minimum due", "statement balance" or "outstanding due", which could be compounded by any difficulties with UI.

In contrast, the bank may not prioritise enabling customers to pay punctually, out of all the product improvements and maintenance, as they are still compensated by late fee charges.

-

Some customers may find navigating the banking app or website to find payment information, verify accuracy, or setting up reminders cumbersome. They might also be resistant towards enabling push notifications from banks, due to digital information overload.

-

Singapore's conservative financial culture breeds a wariness of higher credit limits. Easier access to funds can be tempting and the worst case scenario is spiraling debt, high-interest charges, and a damaged credit score. Many customers, especially those adhering to traditional Asian values of thrift and acting as breadwinners for dependents, prefer a lower limit to avoid these pitfalls and stay on track with their financial goals.

On the flip side, higher credit limits and spending benefit banks through increased interest, fees, and customer retention. Spending data also fuels personalized offers, but banks must account for risk of defaults and regulatory trouble.

4 - I want to have a positive experience when closing my account

-

Customers appreciate being recognized for their loyalty because it builds trust and fosters a two-way relationship. Loyalty programs with rewards like discounts and exclusive perks incentivize repeat business. Additionally, expedited service and personalized attention make them feel valued as individuals.

In today's competitive market, these perks are what loyal customers expect from all brands.

-

Customers can be frustrated if they need to settle outstanding payments after closing their account. It disrupts the closure process, turning a clean break into an unwelcome surprise. This lingering financial obligation creates a sense of incompleteness and raises concerns on whether there will be more unpleasant surprises.

Ideally, banks should ensure a transparent closure process, highlighting any remaining balance and the deadline for settlement to avoid these negative experiences. However, this can be complicated by factors like processing timelines for final transactions and identifying any uncleared charges like interest accrual after closure.

-

Customers can be frustrated by upselling tactics when requesting fee waivers or even account closure. It feels like their financial situation or decision is disregarded in favor of bank profits, prioritizing short-term gain over building a long-term relationship. This is especially true if the bank offered aggressive incentives to attract new customers. The experience can damage trust as they may feel reduced to a number, rather than a valued individual.

Ultimately, customers want to feel heard and appreciated, not just another source of revenue. Banks, however, might attempt upsells during cancellations to salvage the relationship and potentially retain a customer who might be open to a different product or service that better suits their needs.

Effort

Impact

Opportunity 1: I need the right loan for my needs was chosen as the high-impact, low-effort focus for solutioning.

Proposed Solutions